What is E-invoicing

E-invoicing FAQs

1. What is e-invoicing?

E-Invoicing means issuing invoices electronically in a standard digital format that’s sent automatically between the seller, buyer, and the Tax Authority for validation, replacing paper or PDF invoices.

Is this information helpful?

2. What is the difference between paper invoices and e-invoices?

Paper invoices are issued manually and require signatures and stamps. E-invoices are issued digitally, are electronically certified, and carry a unique verification code.

Also, the e-invoices are issued and sent to the buyer and the Tax Authority instantly. They are stored electronically with instant verification and reporting, which is ensuring speed, accuracy, and security.

Is this information helpful?

3. What is the main objective of e-invoicing?

The main objective of e-invoicing is to improve business transaction efficiency, ensure transparency and tax compliance, as well as prevent fraudulent invoices.

Is this information helpful?

4. What are the direct benefits for companies?

Direct benefits for companies include reduced operating costs, simplified auditing, improved data accuracy and inventory management, reduced errors, integration with company systems, secure archiving, and real-time reporting for better decision-making.

Is this information helpful?

5.What are the implementation phases and who are the target groups?

The system will be implemented in 4 phases, each targeting a specific group as follows:

Phase 1: One hundred large VAT-registered companies, implementation begins in August 2026.

Phase 2: All large VAT-registered companies, implementation begins in February 2027.

Phase 3: All remaining VAT-registered taxpayers, implementation begins in August 2027.

Phase 4: Government institutions and entities, implementation begins in February (year to be announced)

Is this information helpful?

6. How were these Taxpayers selected?

Based on criteria such as revenue size, annual invoice volume, and technical readiness.

Is this information helpful?

7. Will SMEs be included?

Yes, within the third phase of the project. Can a company not targeted in the first phase applies the system voluntarily? Yes, optional early adoption is allowed with necessary support provided.

Is this information helpful?

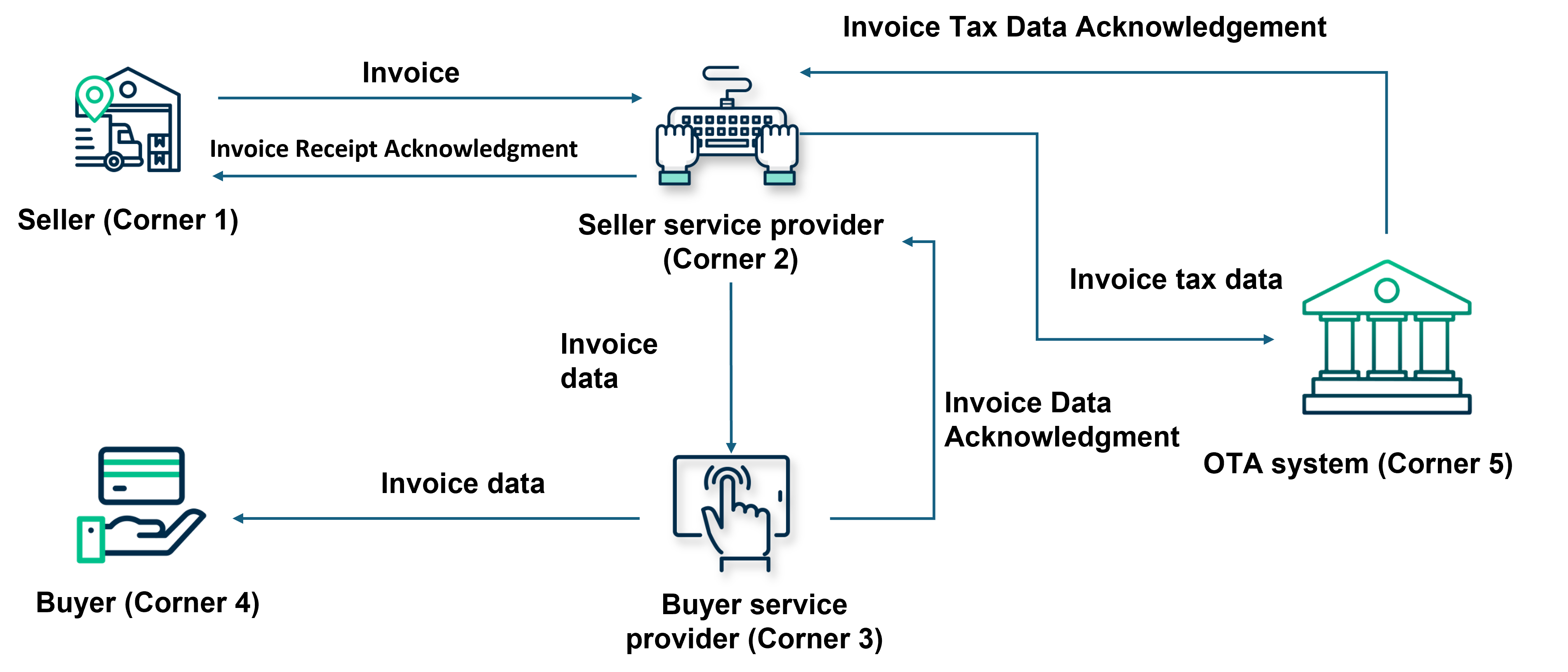

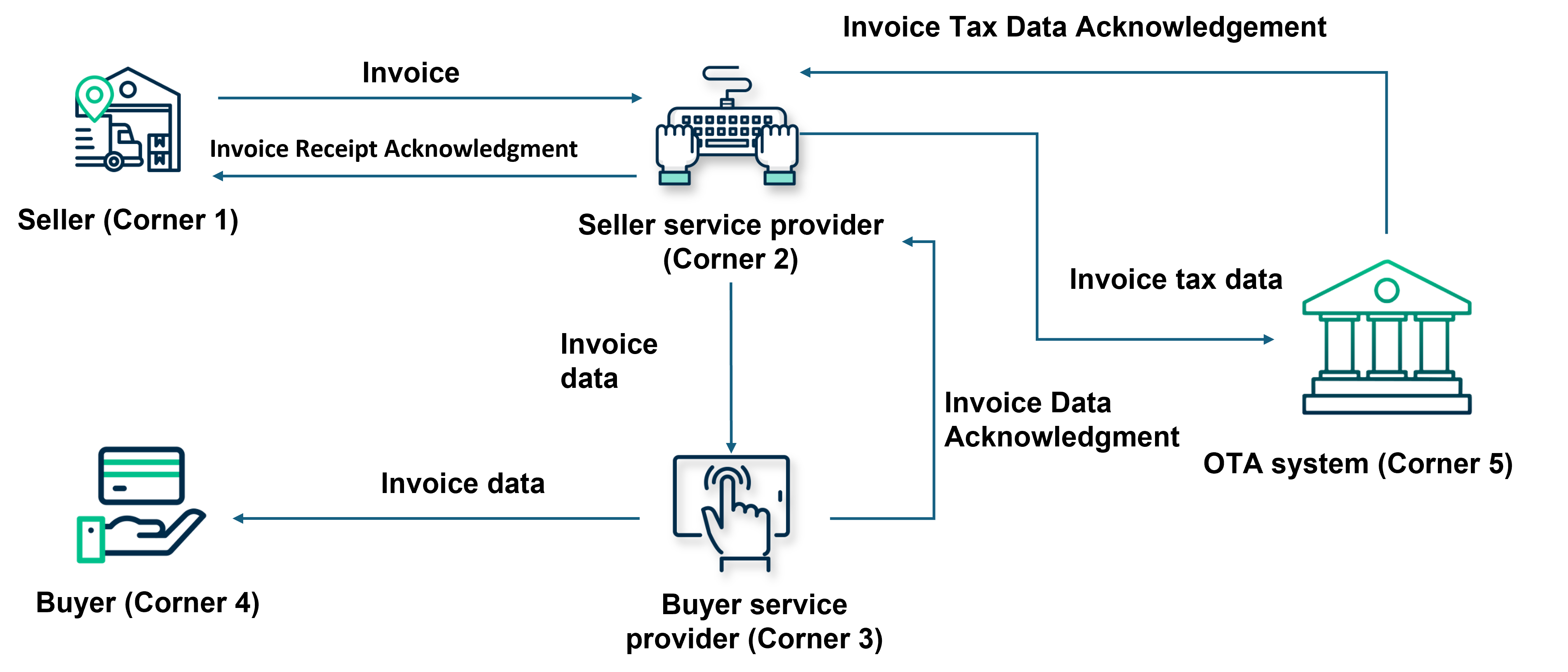

8. How is an e-invoice issued?

Invoices are issued through an electronic operating model linking taxpayers, service providers, tax system, and recipients to ensure secure and standardized issuance.

1. (Supplier)

2. (Supplier’s Service Provider)

3. (Buyer’s Service Provider)

4. (Buyer)

5. (Oman Tax Authority – OTA)

Is this information helpful?

9. Will paper invoices be canceled?

Yes, after official implementation, the electronic invoice will be the only legal document.

Is this information helpful?

10. Can invoices be issued manually then entered electronically?

No, invoices must be issued directly from the approved electronic system.

Is this information helpful?

11. Can an invoice be canceled or modified after issuance?

Yes, by issuing an electronic credit or debit notification.

Is this information helpful?

12. Will there be penalties for non-compliance?

Yes, penalties will be applied according to regulations, with a grace period before enforcement.

Is this information helpful?

13. Does the company need to change its current ERP system?

Not necessarily, integration is possible if it is compatible.

Is this information helpful?

14. Will the Tax Authority provide a free system?

Integration specifications will be provided for updating existing systems.

Is this information helpful?

15. What is the compatibility standard?

Invoice issuance in XML or PDF/A-3 format and API connectivity.

Is this information helpful?

16. Is a digital certificate required?

Yes, to ensure reliability and verification.

Is this information helpful?

17. Will companies receive training before implementation?

Yes, training workshops and practical system training will be provided.

Is this information helpful?

18. Will there be a trial period before enforcement?

Yes, the first phase will include 100 companies as pilots.

Is this information helpful?

19. How can technical support be obtained?

A technical support center and hotline will be established.

Is this information helpful?

20. Will a guidance manual be provided?

Yes, detailed guides and awareness materials will be provided.

Is this information helpful?

21. How will e-invoices be archived?

Invoices will be archived for 10 years (5 years in the system + 5 years in an electronic archive).

Is this information helpful?

22. Can companies access old invoices?

Yes, they can be easily retrieved.

Is this information helpful?

23. How will customers not ready for e-invoices be handled?

Issue electronically and provide a paper copy for display only.

Is this information helpful?

24. Can invoices be issued in two languages?

Yes, the system will support both Arabic and English.

Is this information helpful?